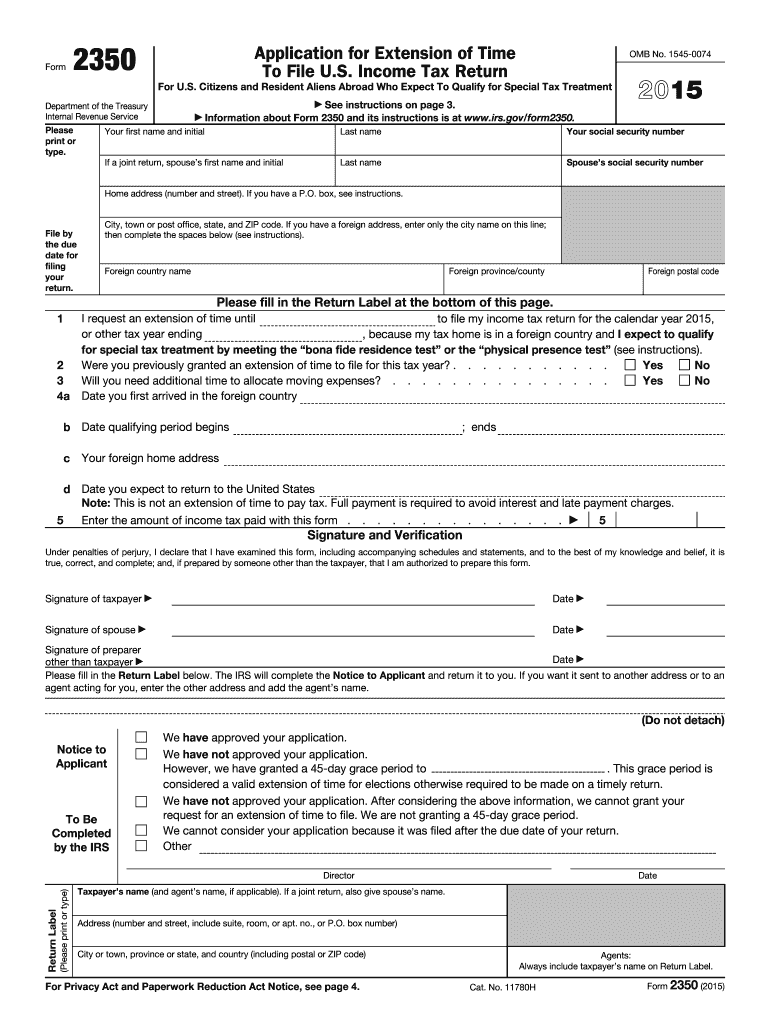

Returns made by nonresident alien individuals (other than those whose wages are subject to withholding under chapter 24). The rule under Internal Revenue Code Section 6072(c) is: Generally, a nonresident alien must report all U.S source income on Form 1040 NR. FILING REQUIREMENTS FOR NON-RESIDENT ALIENS: If you realize too late that you need to declare your U.S source income to the Internal Revenue Service (IRS), you might be able to get an extension of time. Are you are a non-resident alien receiving U.S source income? Examples of US source income include rental income from a property located in the U.S or distributions from a company formed in the United States.

0 kommentar(er)

0 kommentar(er)